Article begins

The first data on the economic impact the COVID-19 virus is having on the cultural resource management (CRM) segment of the heritage industry are in. As might be expected, the results aren’t good. Understanding the context, though, is important for an interpretation of these data and what they might mean for an important part of anthropology and for the employment of anthropologists working in this sector.

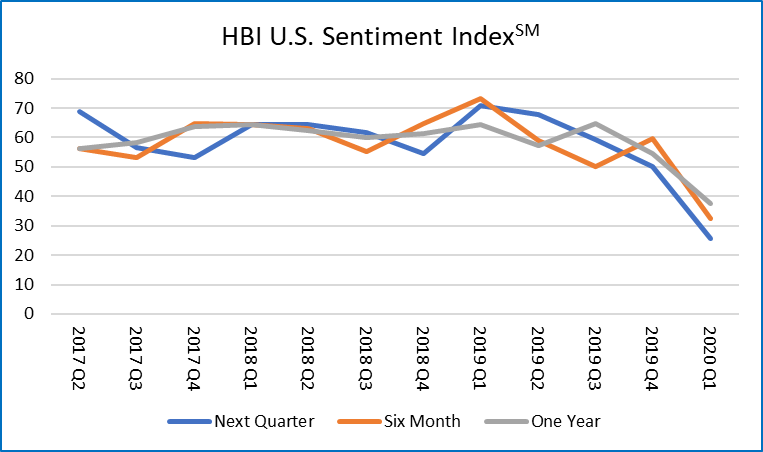

Since 2017, Heritage Business International (HBI) has surveyed the office managers of organizations that provide archaeological consulting services. The survey is an economic sentiment survey. Managers are asked if their anticipated invoice totals for the next quarter, six months, and one year will be greater, less than, or the same as they are from the current quarter. Like many other sentiment surveys, results are expressed in an index centered on 50. Fifty indicates no growth or decline. An index greater than 50 indicates growth; an index lower than 50 indicates contraction.

Image description: The graph title, centered at the top, reads HBI U.S. Sentiment Index followed by a service mark. The graph is a line graph with three lines, one each for the next-quarter (blue), six-month (orange), and one-year (grey) index. The horizonal axis labels each quarter from Q2 2017 (left) to Q1 2020 (right). The vertical axis expresses percent, from 0 (bottom) to 80 (top). From Q2 2017 to Q4 2019, all three lines track within a range from 50 to 70 percent. For Q1 2020, the next-quarter index drops to 25.7; the six-month index drops to 32.6; the one-year index drops to 37.5.

Caption: Historic HBI Quarterly Sentiment Indices. Christopher D. Dore

On April 1, HBI released the results of the United States’ Q1 survey for which data were collected during the last week of March. Based on these results, a sample of 72 office managers from 27 states, the next-quarter index was 25.7. At a 90 percent confidence interval, there is a 9-point margin of error. These data can be interpreted as indicating office managers believe there will be a large contraction in their invoice totals over the next three months and that based on the six- (32.6) and twelve-month (37.5) indices, the contraction will continue over the next year.

By nature, sentiment surveys are both overly optimistic and overly pessimistic. They reflect an opinion on the future. While the opinion may not prove to be accurate, actual economic performance data are always lagging data and, thus, sentiment data are valuable because they are forward looking. On the one hand, as are the rest of us, office managers are at best nervous and at worst scared. It is possible that they are reporting their worst fears that, in the future, may not prove to have been realized. On the other hand, it is also possible that they are underestimating the impact.

Unlike past economic recessions that have resulted in the loss of capital to invest in infrastructure projects, this impact, so far, is different. This is a health crisis causing an economic crisis, a crisis coming from the bottom up rather than from the top down. Capital is currently still available for financing large infrastructure projects. As well, historically, due to the flow of capital there has been an 18-month lag in general economic conditions reaching the CRM economy for both recessions and recoveries. Archaeological consulting is tied to construction and while construction may have slowed some, it hasn’t stopped. At present, many consulting archaeologists continue to work in the field and from home offices. If the economic effects are short-term, the impact to CRM may not be great. For example, the global economic crisis and US recession of 2007–2009 did impact CRM, but not to the extent of causing negative industry growth.

There are other trends in CRM market data that are, and continue to be, at play during the COVID-19 pandemic. The one-quarter office managers’ index has been falling gradually and consistently for five quarters since its all-time survey high of 70.7 in the first quarter of 2019. Growth has been slowing for reasons not related to the pandemic. There are no data to tease out what percentage of the 25.7 current index is due to the pandemic and what percentage is due to this longer market trend. It is interesting that Canadian office managers see the pandemic having little effect on their work. The Canadian one-quarter index dropped from 30.8 (Q4 2019) to 29.2 (Q1 2020). In six months to a year they see stasis with indices near 50. This is in contrast to the United States, where invoice reduction is forecast to continue.

Sentiment surveys, while simple to do, can be difficult to understand. It is unclear if sentiment forecasts will ultimately align with actual economic results. This survey, though, provides the first data on how office managers are forecasting the effects of the COVID-19 pandemic on their businesses and the $800 million-dollar-a-year United States CRM segment that employs many professional anthropologists.

This essay was written on April 4, 2020 based on survey data located here. AAA members can access the report free of charge by adding it to their cart, using the code “AAA_Member,” and completing the checkout process.

Christopher D. Dore is a consultant with Heritage Business International, an LP3 social enterprise venture that works to increase the value, sustainability, and impact of heritage organizations. Dore is one of the few professional archaeologists (RPA 10331; MCIfA 8900) with both a doctoral degree in anthropology and an MBA. He is a past president of both the Register of Professional Archaeologists and the American Cultural Resources Association and has served as the treasurer of the Society for American Archaeology.

Cite as: Dore, Christopher D. 2020. “The Anticipated Impact of COVID-19 on Cultural Resource Management.” Anthropology News website, April 13, 2020. DOI: 10.1111/AN.1377